ParkerGale Indices: A Look Ahead to the Third Quarter and Second Quarter 2024 Earnings Recap

Summary

We are updating our indices that track public software companies, recapping second quarter earnings, and examining growth expectations for the remainder of the year.

In September, the Fed reduced interest rates by 50 basis points, and many analysts cite the softening labor market as justification for the larger cut. Software analysts are hopeful that the rate cut could help revitalize slashed IT budgets or begin to reverse hiring trends in the software market. However, muted demand by enterprise buyers continues to contribute to slower growth rates across public software companies.

A few large-cap software companies hosted investor days post earnings and shared their medium-term revenue growth outlooks. Those firms expect growth in the mid-teens range, citing uncertainty in the macro as a contributing factor to slower growth. During earnings, most of the software companies we tracked outperformed quarterly growth expectations, but management teams did not materially revise 2024 outlooks.

Since we’ve published our indices, software companies have traded in the 4x to 8x revenue range. In context of the 20-year average, software valuations are in line. Valuations for companies that were able to maintain growth and be profitable have seen their valuations rewarded. I continue to believe that analysts have readjusted growth expectations, settling on 20% growth as a floor for high growth names until demand rebounds. But given that most software companies have recently rationalized IT budgets, revenue contribution from AI initiatives remains to be seen, and the upcoming election has introduced more uncertainty into the macro, I would not expect a significant rebound in demand to materialize over the end of 2024.

How Valuations Reacted After the Second Quarter

EV/Sales

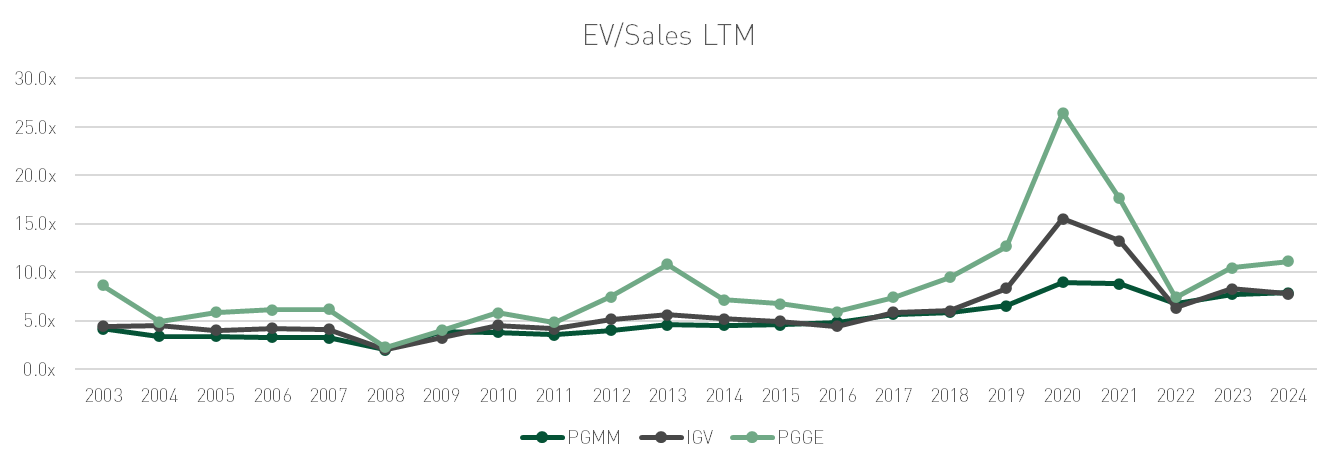

Sales multiples for ParkerGale Middle Market Buyout (PGMM) were stable at 7.8x revenue in the second quarter while sales multiples for ParkerGale Growth Equity (PGGE) increased to 11.1x on average. PGGE traded at a premium over PGMM and the iShares Expanded Tech-Software Sector ETF (IGV) which averaged 7.8x revenue.

The line chart below contains sales multiples for PGMM and PGGE compared to IGV. PGGE companies have increased profitability levels again while growth is decelerating.

This quarter, 24 out of 78 PGMM companies were valued at 10x EV/Sales or higher. Those companies grew revenue 14%, had EBITDA margins of 35%, and traded at 45x EBITDA, a premium over the PGMM index. In PGGE, only seven companies were valued at 10x EV/Sales or higher and grew revenue on average 29% with EBITDA margins of 20%. Revenue growth for those companies decreased compared to last quarter, but EBITDA margins increased. Additionally, that subsegment of PGGE traded at a premium, averaging 14.5x EV/Sales.

The second quarter average LTM sales multiple for PGMM-SC was 3.4x, below the 4.0x to 4.5x range experienced over the previous four quarters. No companies met the threshold for inclusion in PGGE-SC this quarter.

YoY Sales Growth

Below we chart annual sales growth. Revenue growth for PGGE and PGMM was even with the previous quarter, ending at 30% and 13% respectively.

Management teams largely held firm on 2024 outlooks. Many investors believe that guidance remains conservative, so underwriting to high-teens next twelve-month revenue growth rates for software companies seems like a reasonable expectation, especially given the companies have been able to achieve profitability over the past two years.

EV/EBITDA

Finally, we examine EBITDA margins and multiples for our indices. EBITDA multiples for PGMM were in line as margins went to 29%. PGMM-SC had margins of 18% on average and traded at 18.2x EBITDA, providing a base line for exit expectations.

The PGGE cohort increased in profitability this quarter, achieving 20% EBITDA margins. PGGE companies that were able to exceed the group EBITDA margin average commanded a premium valuation. Next twelve-month growth rates at the end of the second quarter were 26% for PGGE and 15% for PGMM.

We revisit the historical Rule of 40 to map how companies are achieving the metric. PGMM has consistently stayed in the high 20% EBITDA margin range and teens revenue growth range. Over time, PGGE has decelerated in growth and relied more on EBITDA margins to achieve Rule of 40.

PGMM growth rates are still stable, which isn’t surprising given that 20% revenue growth has become aspirational for many public software companies. As a result, valuation changes throughout the year did not vary widely.

Background on Our Indices

Here is a recap of each index:

PG Growth Equity (PGGE): All public software companies that grew over 25% in a given calendar year irrespective of profitability.

PG Middle Market Buyout (PGMM): All public software companies that grew between 5% and 25% in a given calendar year, while also maintaining at least 10% EBITDA margins in the same year.

PG Growth Equity Small Cap (PGGE-SC): Public software companies with a market cap between $250 million and $2 billion that grew over 25% in a given calendar year irrespective of profitability.

PG Middle Market Buyout Small Cap (PGMM-SC): Public software companies with a market cap between $250 million and $2 billion that grew between 5% and 25% in a given calendar year, while also maintaining at least 10% EBITDA margins in the same year.

We refreshed the data as of September 19, 2024 to capture second quarter actuals in our charts for trailing sales and EBITDA multiples, revenue growth, and EBITDA margin.

Disclosures

Actual financial data and estimates for the calendar year ending 2024 were pulled from FactSet as of 9/19/2024.

Investing involves risk, including the loss of all or a significant portion of amounts invested. Past performance is not a guarantee of future results.

The information contained herein is for informational purposes only and should not be considered investment advice. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitutes our judgment and are subject to change without notice. All information with respect to industry data has been obtained from sources believed to be reliable and current, but accuracy cannot be guaranteed. Certain economic and market information contained herein has been obtained from published sources and/or prepared by other parties and current as of the date of publication shown.

Investors cannot invest directly in an index. Indices may change over time. Indices are not an investment and, therefore, have no investment performance history. Index performance does not include risks, fees, or other costs. Past index performance is no indication of future results for the index or for any investment.

IWM-Tech – Consists of all Packaged Software stocks as classified by FactSet within the iShares Russell 2000 ETF (IWM). The iShares Russell 2000 ETF (IWM) seeks to track the investment results of an index composed of small-capitalization U.S. equities.

IGV - iShares Expanded Tech-Software Sector ETF – The iShares Expanded Tech-Software Sector ETF seeks to track the investment results of an index composed of North American equities in the software industry and select North American equities from interactive home entertainment and interactive media and services industries.